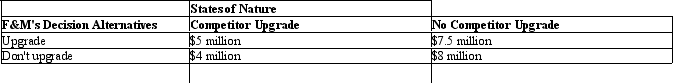

Game Theory. F&M Manufacturing, Inc., a diversified manufacturer of packaging products, is considering upgrading its current line by making available a new line of coated paper products. Of course, the market response to this upgrade in product quality would depend on the competitor response, if any. The company's comptroller projects the following annual profits (payoffs) following resolution of the upgrade decision.

A. Which decision alternative would F&M choose given a secure strategy criterion? Explain.

A. Which decision alternative would F&M choose given a secure strategy criterion? Explain.

B. Calculate the opportunity loss or regret matrix.

C. Which decision alternative would F&M choose if the company seeks to minimize opportunity cost? Explain.

Correct Answer:

Verified

Q37: When E(R) = $100,000, only a risk-seeking

Q38: Certainty Equivalents. Pier-4, Inc. is a rapidly

Q39: Expected Return Analysis. Dr. John Carter offers

Q40: When the dispersion of possible returns is

Q41: Standard Normal. Personal Business Cards, Inc. supplies

Q42: Game Theory. Catskill Mountain Bike, Inc. is

Q43: Game Theory. Jessica's, a local retailer of

Q44: Decision Trees. Arnie Becker, an attorney with

Q45: Standard Normal. Chip Technologies, Inc. supplies wafer-thin

Q46: Standard Normal. University Savings, Inc offers personal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents