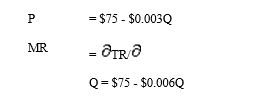

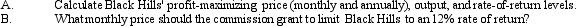

Monopoly Regulation. The Black Hills Telephone Company, a utility serving rural customers in South Dakota is currently engaged in a rate case with the regulatory commission under whose jurisdiction it operates. At issue is the monthly rate the company will charge for call waiting service. The demand curve for this monthly service is P = $6.25 - $0.00025Q. This implies annual demand and marginal revenue curves of:

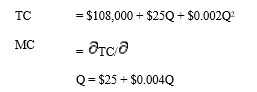

where P is service price in dollars and Q is the number of customers served. Total and marginal costs per year (before investment return) are described by the function:

The company has assets of $100,000 used for call waiting services and the utility commission has authorized a 12% return on investment.

Correct Answer:

Verified

Q40: Price Discrimination. Metropolitan bus service companies in

Q41: Tariffs. The Nippon Switch Corporation is an

Q42: Pollution Regulation. Blue Gem, Inc., processes almonds

Q43: Costs of Regulation. Biosystems Technology, Inc., manufacturers

Q44: Monopoly Regulation. The Hoosier Gas Company, a

Q46: Monopoly Regulation. The Woebegone Telephone Company, a

Q47: Tariffs. The Steel Supply Corporation is an

Q48: Monopoly Regulation. The Redwood Cable Company, a

Q49: Pollution Regulation. Porky Pig, Inc., processes hogs

Q50: Tariffs. The Northern Lights Company is an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents