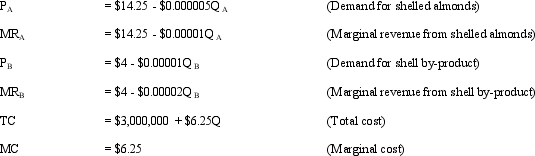

Pollution Regulation. Blue Gem, Inc., processes almonds at a large facility in Redding, California. Each pound of almonds processed yields both shelled almonds and shell by-product in a fixed 1:1 ratio. Although the by-product is unfit for human consumption, some can be sold to a regional manufacturer of stone-washed denim garments (the shells are crushed and used as abrasives). Relevant annual demand and cost relations are:

Here P is price in dollars, Q is the number of pounds of almonds processed, QA and QB are shelled almonds and shell by-product per pound of almonds, respectively; both total and marginal costs are in dollars. Total costs include a risk-adjusted normal return of 15% on a $10 million investment in plant and equipment.

Here P is price in dollars, Q is the number of pounds of almonds processed, QA and QB are shelled almonds and shell by-product per pound of almonds, respectively; both total and marginal costs are in dollars. Total costs include a risk-adjusted normal return of 15% on a $10 million investment in plant and equipment.

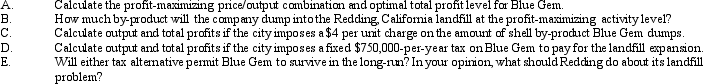

Currently, the city allows the company to dump excess by-product into its landfill at no charge, viewing the service as an attractive means of keeping a valued employer in the area. However, the landfill is quickly approaching peak capacity and must be expanded at an expected operating cost of $750,000 per year. This is an impossible burden on an already strained city budget.

Correct Answer:

Verified

Q37: Monopoly Equilibrium. Paradox Dental, Ltd., enjoys a

Q38: The F.T.C. enforces antitrust laws by:

A) sentencing

Q39: Monopoly Equilibrium. The Athletic Medicine Center in

Q40: Price Discrimination. Metropolitan bus service companies in

Q41: Tariffs. The Nippon Switch Corporation is an

Q43: Costs of Regulation. Biosystems Technology, Inc., manufacturers

Q44: Monopoly Regulation. The Hoosier Gas Company, a

Q45: Monopoly Regulation. The Black Hills Telephone Company,

Q46: Monopoly Regulation. The Woebegone Telephone Company, a

Q47: Tariffs. The Steel Supply Corporation is an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents