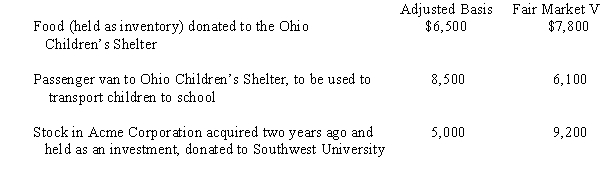

Grocer Services Corporation (a calendar year taxpayer) ,a wholesale distributor of food,made the following donations to qualified charitable organizations during the year:

How much qualifies for the charitable contribution deduction?

A) $21,800.

B) $24,840.

C) $24,100.

D) $22,450.

E) None of the above.

Correct Answer:

Verified

Q72: Beth and Debbie are equal owners in

Q73: Saguaro Corporation,a cash basis and calendar year

Q74: Which of the following statements is incorrect

Q75: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q76: Wallaby,Inc.,a calendar year C corporation,had the following

Q78: Which of the following statements is correct

Q79: Shaw,an architect,is the sole shareholder of Shaw

Q80: During 2008,Sparrow Corporation,a calendar year C corporation,had

Q81: During the year,Quartz Corporation (a calendar year

Q82: Nicole owns and operates a sole proprietorship.She

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents