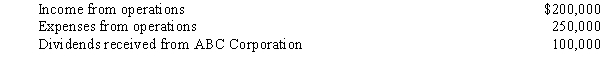

During the year,Quartz Corporation (a calendar year taxpayer)has the following transactions:

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: Wallaby,Inc.,a calendar year C corporation,had the following

Q77: Grocer Services Corporation (a calendar year taxpayer),a

Q78: Which of the following statements is correct

Q79: Shaw,an architect,is the sole shareholder of Shaw

Q80: During 2008,Sparrow Corporation,a calendar year C corporation,had

Q82: Nicole owns and operates a sole proprietorship.She

Q83: Distinguish between organizational expenditures and start-up expenditures

Q84: On December 29,2008,the directors of Greyhawk Enterprises

Q85: Under FIN 48,an entity must evaluate tax

Q86: Compare the basic tax and nontax factors

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents