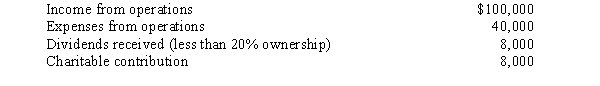

Wallaby,Inc.,a calendar year C corporation,had the following income and expenses in 2008:

A)How much is Wallaby, Inc.'s charitable contribution deduction for 2008?

B)What happens to the portion of the contribution not deductible in 2008?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: Beige Company has approximately $400,000 in net

Q72: Beth and Debbie are equal owners in

Q73: Saguaro Corporation,a cash basis and calendar year

Q74: Which of the following statements is incorrect

Q75: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q77: Grocer Services Corporation (a calendar year taxpayer),a

Q78: Which of the following statements is correct

Q79: Shaw,an architect,is the sole shareholder of Shaw

Q80: During 2008,Sparrow Corporation,a calendar year C corporation,had

Q81: During the year,Quartz Corporation (a calendar year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents