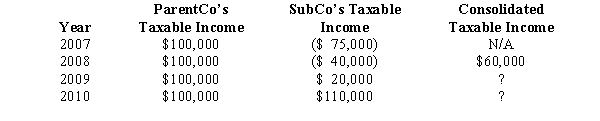

ParentCo purchased all of the stock of SubCo on January 2,2008,and the two companies filed consolidated returns for 2008 and thereafter.Both entities were incorporated in 2007.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.No § 382 limit applies.

To what extent can SubCo's 2007 losses be used by the group in 2010?

A) $175,000.

B) $130,000.

C) $90,000.

D) $0.

E) Some other amount.

Correct Answer:

Verified

Q61: ParentCo and SubCo had the following items

Q62: ParentCo's separate taxable income was $100,000,and SubCo's

Q64: Which of the following statements is true

Q65: ParentCo and SubCo had the following items

Q67: ParentCo and SubCo had the following items

Q68: ParentCo and SubCo had the following items

Q69: The purpose of the rules governing intercompany

Q71: Match each of the following terms with

Q101: Match each of the following terms with

Q118: Match each of the following terms with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents