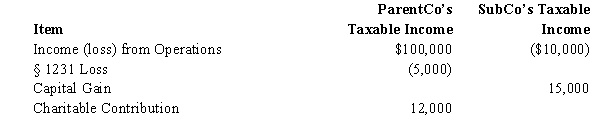

ParentCo and SubCo had the following items of income and deduction for the current year.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $81,000.

B) $88,000.

C) $90,000.

D) $90,500.

E) Some other amount.

Correct Answer:

Verified

Q60: The consolidated net operating loss of Parent

Q61: ParentCo and SubCo had the following items

Q62: ParentCo's separate taxable income was $100,000,and SubCo's

Q64: Which of the following statements is true

Q66: ParentCo purchased all of the stock of

Q67: ParentCo and SubCo had the following items

Q68: ParentCo and SubCo had the following items

Q69: The purpose of the rules governing intercompany

Q101: Match each of the following terms with

Q118: Match each of the following terms with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents