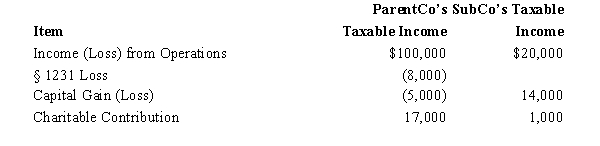

ParentCo and SubCo had the following items of income and deduction for the current year.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $107,000.

B) $108,000.

C) $108,900.

D) $115,800.

E) $121,000.

Correct Answer:

Verified

Q56: Conformity among the members of a consolidated

Q57: ParentCo purchased all of the stock of

Q58: How are the members of a Federal

Q59: ParentCo owned 100% of SubCo for the

Q60: The consolidated net operating loss of Parent

Q62: ParentCo's separate taxable income was $100,000,and SubCo's

Q64: Which of the following statements is true

Q65: ParentCo and SubCo had the following items

Q66: ParentCo purchased all of the stock of

Q101: Match each of the following terms with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents