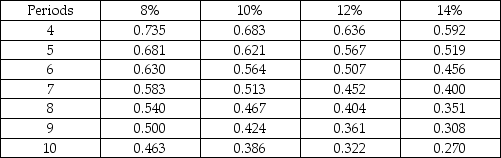

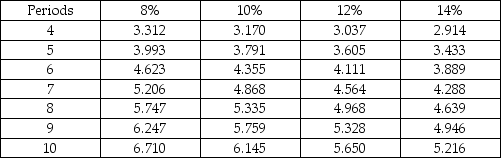

Reece Corporation is considering the purchase of a machine that would cost $24,388 and would have a useful life of 6 years. The machine would generate $5600 of net annual cash inflows per year for each of the 6 years of its life. The internal rate of return on the machine would be closest to: Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

A) 6%.

B) 8%.

C) 10%.

D) 12%.

Correct Answer:

Verified

Q136: When selecting a capital investment project from

Q137: The residual value is considered in a

Q138: The net present value method assumes that

Q139: The hurdle rate is the length of

Q140: When evaluating the cash flows from an

Q142: A company finds that the residual value

Q143: Karpets Industries is investing in a new

Q144: Ryker Manufacturing is evaluating investing in a

Q145: Byer, a plastics processor, is considering the

Q146: The Speedy-Delivery Company has two options for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents