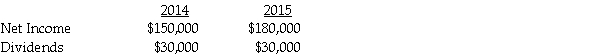

Patterson Company acquired 90% of Starr Corporation on January 1,2014 for $2,250,000.Starr had net assets at that time with a fair value of $2,500,000.At the time of the acquisition,Patterson computed the annual excess fair-value amortization to be $20,000,based on the difference between Starr's net book value and net fair value.Assume the fair value exceeds the book value,and $20,000 pertains to the whole company.Separate from any earnings from Starr,Patterson reported net income in 2014 and 2015 of $550,000 and $575,000,respectively.Starr reported the following net income and dividend payments:

Required: Calculate the following:

• Investment in Starr shown on Patterson's ledger at December 31,2014 and 2015.

• Investment in Starr shown on the consolidated statements at December 31,2014 and 2015.

• Consolidated net income for 2014 and 2015.

• Noncontrolling interest balance on Patterson's ledger at December 31,2014 and 2015.

• Noncontrolling interest balance on the consolidated statements at December 31,2014 and 2015.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: On July 1,2014,Polliwog Incorporated paid cash for

Q29: On January 2,2014,Power Incorporated paid $630,000 for

Q30: On January 1,2014,Myna Corporation issued 10,000 shares

Q31: On July 1,2014,Piper Corporation issued 23,000 shares

Q32: Passcode Incorporated acquired 90% of Safe Systems

Q33: Petra Corporation paid $500,000 for 80% of

Q34: Pool Industries paid $540,000 to purchase 75%

Q35: Park Corporation paid $180,000 for a 75%

Q37: Passerby International purchased 80% of Standaround Company's

Q38: The consolidated balance sheet of Pasker Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents