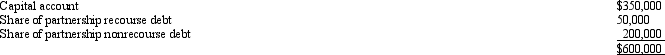

The MOP Partnership is involved in leasing heavy equipment under long-term leases of five years or more. Patricia has an adjusted basis for her partnership interest on January 1 of the current year of $600,000, consisting of the following:

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia. Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is a material participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss?

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia. Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits, capital, and losses, and is a material participant in the partnership, how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Meagan is a 40% general partner in

Q92: During the current year, MAC Partnership reported

Q94: In the current year, the CAR Partnership

Q95: Match each of the following statements with

Q96: The MOG Partnership reports ordinary income of

Q98: Match each of the following statements with

Q99: Sharon and Sara are equal partners in

Q127: Crystal contributes land to the newly formed

Q141: Harry and Sally are considering forming a

Q147: Katherine invested $80,000 this year to purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents