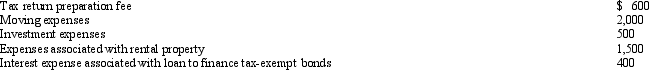

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Q83: In January, Lance sold stock with a

Q84: For an activity classified as a hobby,

Q90: Which of the following must be capitalized

Q91: Priscella pursued a hobby of making bedspreads

Q92: Melba incurred the following expenses for her

Q93: Nikeya sells land (adjusted basis of $120,000)

Q96: If a residence is used primarily for

Q97: Which of the following is not deductible?

A)Moving

Q97: Arnold and Beth file a joint return.Use

Q98: On January 2, 2012, Fran acquires a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents