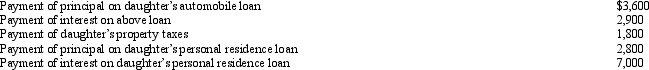

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Q83: In January, Lance sold stock with a

Q84: For an activity classified as a hobby,

Q87: Bob and April own a house at

Q90: Which of the following must be capitalized

Q91: Priscella pursued a hobby of making bedspreads

Q94: Which of the following is not a

Q94: Cory incurred and paid the following expenses:

Q97: Which of the following is not deductible?

A)Moving

Q97: Arnold and Beth file a joint return.Use

Q98: On January 2, 2012, Fran acquires a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents