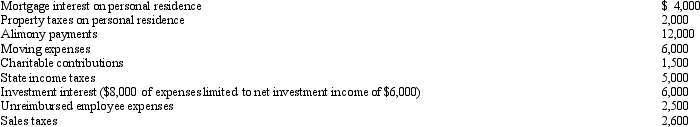

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: If a vacation home is determined to

Q84: For an activity classified as a hobby,

Q92: Melba incurred the following expenses for her

Q93: Nikeya sells land (adjusted basis of $120,000)

Q94: Cory incurred and paid the following expenses:

Q96: If a residence is used primarily for

Q97: Which of the following is not deductible?

A)Moving

Q98: On January 2, 2012, Fran acquires a

Q101: Bridgett's son, Hubert, is $10,000 in arrears

Q102: Marvin spends the following amounts on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents