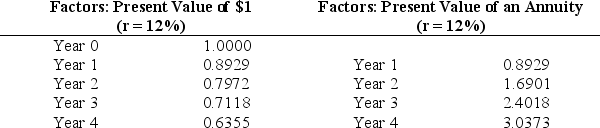

Idlewood Production Company would like to purchase a production machine for $450,000.The machine is expected to have a life of four years,and a salvage value of $50,000.Annual maintenance costs will total $12,500.Annual savings are predicted to be $175,000.The company's required rate of return is 12 percent.

(1)Calculate the net present value of this investment (ignore income taxes).Round all calculations to the nearest dollar.

(2)Based on your answer in requirement 1,should Idlewood purchase the production machine?

Correct Answer:

Verified

Q53: Solutions Inc.would like to purchase a new

Q58: Exhibit 8-1

A project requires an initial

Q61: Niwot Inc.is considering an investment that will

Q63: Davies Inc.would like to purchase a new

Q64: Before income taxes,McFadden Company had revenues of

Q66: Rambus Inc.would like to purchase a production

Q67: Lanyard Company is considering an investment that

Q67: Nolan Company would like to open an

Q69: Niwot Inc.is considering an investment that will

Q70: Lockwood Company would like to purchase a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents