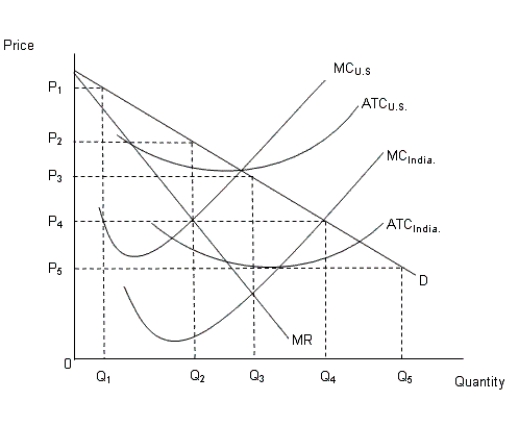

The figure given below shows the demand curve in the U.S. and the cost curves in U.S. and India.Figure: 16.4

In the figure:

In the figure:

MC: Marginal cost curve

ATC: Average total cost curve

D: Demand curve in the U.S.MR: Marginal revenue curve in the U.S.

-Suppose a tax rate of 10 percent applies to all income up to $20,000 a year, income above $20,000 up to $50,000 a year is taxed at a rate of 15%, and income above $50,000 a year is taxed at 20%. Calculate the absolute amount of tax paid by a person whose annual income is $30,000.

A) $2,000

B) $2,500

C) $4,500

D) $4,000

E) $3,500

Correct Answer:

Verified

Q55: The figure given below shows the income-leisure

Q56: The figure given below shows the demand

Q57: The figure given below shows the demand

Q58: The figure given below shows the income-leisure

Q59: The figure given below shows the income-leisure

Q61: The figure given below shows the income-leisure

Q62: The figure given below shows the income-leisure

Q63: The figure given below shows the income-leisure

Q64: The figure given below shows the income-leisure

Q65: The following figures show the demand (D)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents