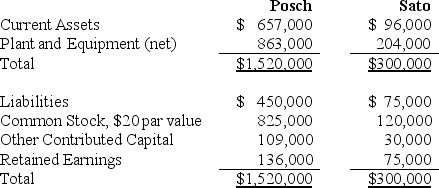

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company.On the date of the combination,Posch Company common stock had a fair value of $30 per share.Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and Sato Company's net assets have a fair value of $343,200,Posch Company's balance sheet immediately after the combination will include goodwill of:

If the business combination is treated as an acquisition and Sato Company's net assets have a fair value of $343,200,Posch Company's balance sheet immediately after the combination will include goodwill of:

A) $15,300.

B) $19,200.

C) $16,800.

D) $28,200.

Correct Answer:

Verified

Q22: If an impairment loss is recorded on

Q27: Briefly describe the different treatment under SFAS

Q28: Maplewood Corporation purchased the net assets of

Q29: Edina Company acquired the assets (except cash)and

Q29: Under SFAS 141R, what value of the

Q30: The stockholders' equities of Penn Corporation and

Q33: The fair value of net identifiable assets

Q33: Condensed balance sheets for Rich Company and

Q35: Following its acquisition of the net assets

Q36: Porpoise Corporation acquired Sims Company through an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents