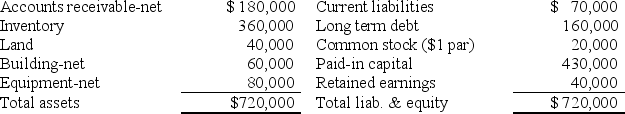

Maplewood Corporation purchased the net assets of West Corporation on January 2,2016 for $560,000 and also paid $20,000 in direct acquisition costs.West's balance sheet on January

1,2016 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $400,000,$50,000 and $70,000,respectively.West has patent rights valued at $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $400,000,$50,000 and $70,000,respectively.West has patent rights valued at $20,000.

Required:

A.Prepare Maplewood's general journal entry for the cash purchase of West's net assets.

B.Assume Maplewood Corporation purchased the net assets of West Corporation for $500,000 rather than $560,000,prepare the general journal entry.

Correct Answer:

Verified

Q24: Balance sheet information for Hope Corporation at

Q25: North Company issued 24,000 shares of its

Q27: Briefly describe the different treatment under SFAS

Q29: Edina Company acquired the assets (except cash)and

Q29: Under SFAS 141R, what value of the

Q30: The stockholders' equities of Penn Corporation and

Q31: Posch Company issued 12,000 shares of its

Q33: The fair value of net identifiable assets

Q33: Condensed balance sheets for Rich Company and

Q40: P Company acquires all of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents