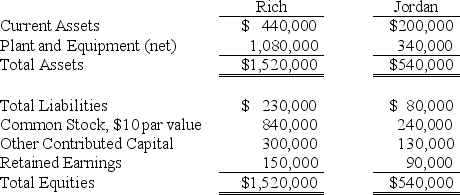

Condensed balance sheets for Rich Company and Jordan Company on January 1,2016 are as follows:

On January 1,2016 the stockholders of Rich and Jordan agreed to a consolidation whereby a new corporation,Cannon Company,would be formed to consolidate Rich and Jordan.Cannon Company issued 70,000 shares of its $20 par value common stock for the net assets of Rich and Jordan.On the date of consolidation,the fair values of Rich's and Jordan's current assets and liabilities were equal to their book values.The fair value of plant and equipment for each company was: Rich,$1,270,000; Jordan,$360,000.

On January 1,2016 the stockholders of Rich and Jordan agreed to a consolidation whereby a new corporation,Cannon Company,would be formed to consolidate Rich and Jordan.Cannon Company issued 70,000 shares of its $20 par value common stock for the net assets of Rich and Jordan.On the date of consolidation,the fair values of Rich's and Jordan's current assets and liabilities were equal to their book values.The fair value of plant and equipment for each company was: Rich,$1,270,000; Jordan,$360,000.

An investment banking house estimated that the fair value of Cannon Company's common stock was $35 per share.Rich will incur $45,000 of direct acquisition costs and $15,000 in stock issue costs.

Required:

Prepare the journal entries to record the consolidation on the books of Cannon Company assuming that the consolidation is accounted for as an acquisition.

Correct Answer:

Verified

Q22: If an impairment loss is recorded on

Q28: Maplewood Corporation purchased the net assets of

Q29: Under SFAS 141R, what value of the

Q29: Edina Company acquired the assets (except cash)and

Q30: The stockholders' equities of Penn Corporation and

Q31: Posch Company issued 12,000 shares of its

Q35: Following its acquisition of the net assets

Q36: Porpoise Corporation acquired Sims Company through an

Q37: North Company issued 24,000 shares of its

Q38: On May 1,2016,the Phil Company paid $1,200,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents