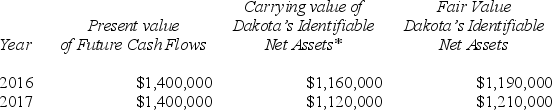

On January 1,2013,Brighton Company acquired the net assets of Dakota Company for $1,580,000 cash.The fair value of Dakota's identifiable net assets was $1,310,000 on his date.Brighton Company decided to measure goodwill impairment using the present value of future cash flows to estimate the fair value of the reporting unit (Dakota).The information for these subsequent years is as follows:

* Identifiable net assets do not include goodwill.

* Identifiable net assets do not include goodwill.

Required:

A: For each year determine the amount of goodwill impairment,if any.

B: Prepare the journal entries needed each year to record the goodwill impairment (if any)on Brighton's books.

Correct Answer:

Verified

Q22: If an impairment loss is recorded on

Q26: The fair value of net identifiable assets

Q29: Under SFAS 141R, what value of the

Q33: Condensed balance sheets for Rich Company and

Q35: Following its acquisition of the net assets

Q36: Porpoise Corporation acquired Sims Company through an

Q37: North Company issued 24,000 shares of its

Q38: On May 1,2016,the Phil Company paid $1,200,000

Q40: The managers of Savage Company own 10,000

Q41: The following balance sheets were reported on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents