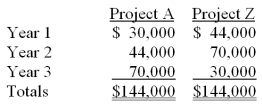

A company is considering two alternative investment opportunities, each of which requires an initial cash outlay of $110,000. The expected net cash flows from the two projects follow:

Required:

(1) Based on a comparison of their net present values, and assuming the same discount rate (greater than zero) is required for both projects, which project is the better investment? (Check one answer.)

________________ Project A

________________ Project Z

________________ The projects are equally desirable

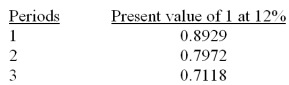

(2) Use the table values below to find the net present value of the cash flows associated with Project A, discounted at 12%:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: A company produces two boat models,

Q120: A company produces two boat models,

Q122: A company has a decision to

Q122: The process of restating future cash flows

Q123: A company is considering a 5-year project.

Q125: A company is considering the purchase of

Q127: A company is considering a 5-year project.

Q145: A capital budgeting method that considers how

Q148: The _ is computed by dividing a

Q186: The _ is the rate that yields

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents