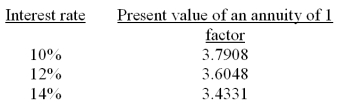

A company is considering a 5-year project. It plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: A company produces two boat models,

Q120: A company produces two boat models,

Q122: A company has a decision to

Q122: The process of restating future cash flows

Q124: A company is considering two alternative investment

Q125: A company is considering the purchase of

Q127: A company is considering a 5-year project.

Q137: A company is evaluating the purchase of

Q145: A capital budgeting method that considers how

Q148: The _ is computed by dividing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents