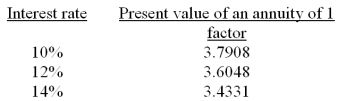

A company is considering a 5-year project. It plans to invest $80,000 now and it forecasts cash inflows for each year of $22,857. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: The process of restating future cash flows

Q122: A company has a decision to

Q123: A company is considering a 5-year project.

Q124: A company is considering two alternative investment

Q125: A company is considering the purchase of

Q138: For projects financed from borrowed funds,the hurdle

Q142: The minimum acceptable rate of return on

Q145: A capital budgeting method that considers how

Q182: In evaluating capital budgeting alternatives, there are

Q186: The _ is the rate that yields

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents