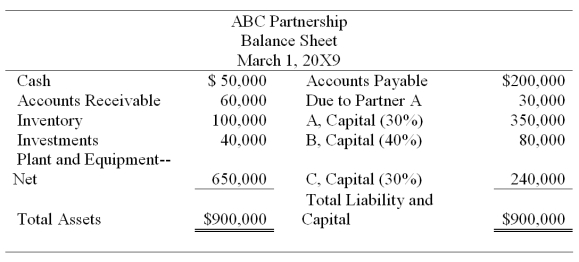

On March 1, 20X9, the ABC partnership decides to complete a lump-sum liquidation as soon as possible. The partnership balance sheet prepared on March 1 appears below:  The partners share profits and losses in the ratio of 3:4:3. Partner B is personally insolvent, but partners A and C have sufficient personal assets to satisfy any capital deficits. On March 15, 20X9, the non-cash assets are sold for $550,000. Lump sum payments are made to the partners on March 16, immediately after the creditors have been paid.

The partners share profits and losses in the ratio of 3:4:3. Partner B is personally insolvent, but partners A and C have sufficient personal assets to satisfy any capital deficits. On March 15, 20X9, the non-cash assets are sold for $550,000. Lump sum payments are made to the partners on March 16, immediately after the creditors have been paid.

Required:

Prepare a statement of partnership realization and liquidation.

Correct Answer:

Verified

Q37: Partners Dennis and Lilly have decided to

Q39: Bill, Page, Larry, and Scott have decided

Q41: Refer to the facts in Question 46.The

Q41: A personal statement of financial condition dated

Q44: The partnership of Rachel, Adams, and Nixon

Q46: When Disney and Charles decided to incorporate

Q46: The JKL partnership liquidated its business in

Q52: A partnership may be involved in "Dissociation"

Q54: Listen and Hear are thinking of dissolving

Q56: The computation of a safe installment payment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents