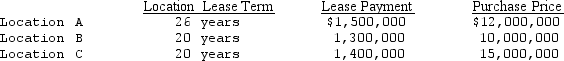

Monsieur Retail Stores is negotiating three leases for store locations.Monsieur's incremental borrowing rate is 12 percent.Each store will have an economic useful life of 30 years.Lease payments will be made at the end of each year.Based on the data below,properly classify each of the leases as an operating lease or a capital lease.The purchase price for each property is listed as an alternative to leasing.

Determine whether each of the leases should be classified by Monsieur as an operating lease or a capital lease.Show computations and reasons to support your answers.

Determine whether each of the leases should be classified by Monsieur as an operating lease or a capital lease.Show computations and reasons to support your answers.

Correct Answer:

Verified

Q69: Bayou Inc.leases equipment to its customers under

Q70: On January 1,2014,Benjamin Industries leased equipment on

Q71: Ollie Company entered into a lease agreement

Q72: Soundesign Company entered into a lease of

Q73: Jefferson Financing,Inc.purchased a packing machine to lease

Q74: Neils Company leased an asset for use

Q75: NPR leased a special crane to WLRN

Q76: On January 1,2014,J.M.Rodriguez,owner of JMR Sound,sold the

Q77: On January 1,2014,Logan Company leased a machine

Q78: Which of the following is true regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents