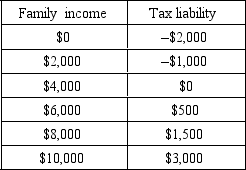

This table shows a payment schedule for a hypothetical negative income tax program.

-From the table,it can be seen that

A) families with an income of $2,000 must pay taxes of $1,000.

B) $4,000 is the poverty level of income.

C) families earning $3,000 find their after-tax incomes increased to $3,500.

D) the tax rate on incomes above $4,000 is constant.

E) this tax scheme is a regressive tax.

Correct Answer:

Verified

Q50: An antipoverty program structured along the conceptual

Q51: Assume a negative income tax that is

Q52: An argument against income transfer programs is

Q53: Occupational wage rates tied to a point

Q54: The negative income tax is a

A) principle

Q55: Reducing or eliminating discrimination in labor markets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents