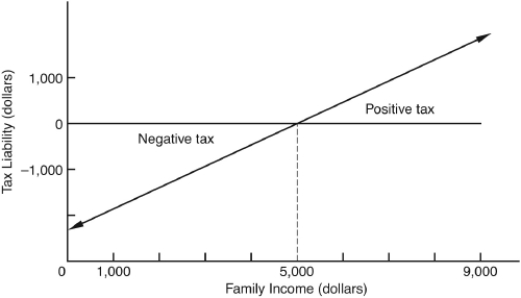

-In the diagram

A) the tax rate is regressive over all incomes.

B) the dollar amount of tax liability falls as income rises.

C) all family incomes of less than $5,000 before taxes are raised to $5,000 with the negative tax payment.

D) families with incomes of $3,000 receive a $1,000 payment.

E) the amounts of negative and positive taxes balance out so the government will just break even.

Correct Answer:

Verified

Q50: An antipoverty program structured along the conceptual

Q51: Assume a negative income tax that is

Q52: An argument against income transfer programs is

Q53: Occupational wage rates tied to a point

Q54: The negative income tax is a

A) principle

Q55: Reducing or eliminating discrimination in labor markets

Q57: This table shows a payment schedule for

Q58: In 1996,the government replaced Aid to Families

Q59: Suppose a family with an earned income

Q60: Some elements of a negative income tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents