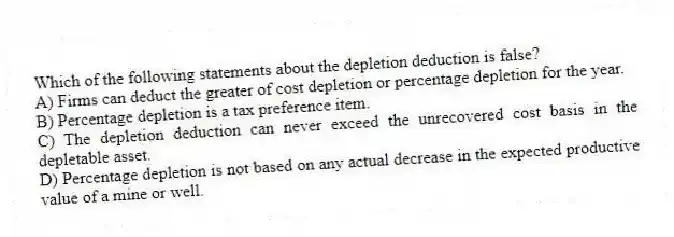

Which of the following statements about the depletion deduction is false?

A) Firms can deduct the greater of cost depletion or percentage depletion for the year.

B) Percentage depletion is a tax preference item.

C) The depletion deduction can never exceed the unrecovered cost basis in the depletable asset.

D) Percentage depletion is not based on any actual decrease in the expected productive value of a mine or well.

Correct Answer:

Verified

Q92: Merkon Inc.must choose between purchasing a new

Q100: Vane Company, a calendar year taxpayer,

Q101: Terrance Inc., a calendar year taxpayer, purchased

Q103: NRW Company, a calendar year taxpayer, purchased

Q104: Creighton, a calendar year corporation, reported $5,571,000

Q105: Shelley purchased a residential apartment for $1,400,000

Q106: B&P Inc., a calendar year corporation, purchased

Q107: Driller Inc. has $498,200 of unrecovered capitalized

Q108: Follen Company is a calendar year taxpayer.

Q109: On November 7, a calendar year business

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents