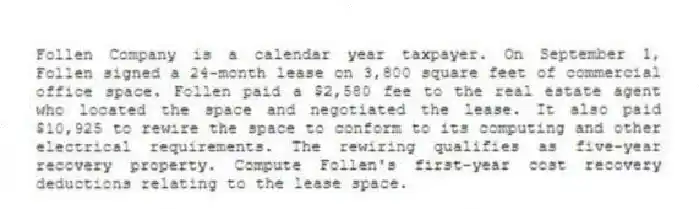

Follen Company is a calendar year taxpayer. On September 1, Follen signed a 24-month lease on 3,800 square feet of commercial office space. Follen paid a $2,580 fee to the real estate agent who located the space and negotiated the lease. It also paid $10,925 to rewire the space to conform to its computing and other electrical requirements. The rewiring qualifies as five-year recovery property. Compute Follen's first-year cost recovery deductions relating to the lease space.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: NRW Company, a calendar year taxpayer, purchased

Q104: Which of the following statements about the

Q105: Shelley purchased a residential apartment for $1,400,000

Q106: B&P Inc., a calendar year corporation, purchased

Q107: Driller Inc. has $498,200 of unrecovered capitalized

Q109: On November 7, a calendar year business

Q110: Which of the following intangible assets is

Q111: On May 1, Sessi Inc., a

Q112: Four years ago, Bettis Inc. paid a

Q113: Pratt Inc. reported $198,300 book depreciation on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents