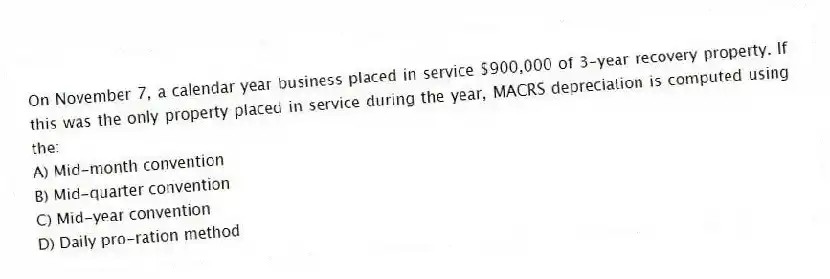

On November 7, a calendar year business placed in service $900,000 of 3-year recovery property. If this was the only property placed in service during the year, MACRS depreciation is computed using the:

A) Mid-month convention

B) Mid-quarter convention

C) Mid-year convention

D) Daily pro-ration method

Correct Answer:

Verified

Q104: Which of the following statements about the

Q105: Shelley purchased a residential apartment for $1,400,000

Q106: B&P Inc., a calendar year corporation, purchased

Q107: Driller Inc. has $498,200 of unrecovered capitalized

Q108: Follen Company is a calendar year taxpayer.

Q110: Which of the following intangible assets is

Q111: On May 1, Sessi Inc., a

Q112: Four years ago, Bettis Inc. paid a

Q113: Pratt Inc. reported $198,300 book depreciation on

Q114: Which of the following expenditures must be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents