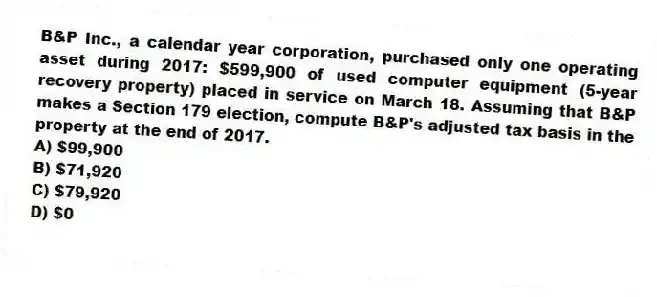

B&P Inc., a calendar year corporation, purchased only one operating asset during 2017: $599,900 of used computer equipment (5-year recovery property) placed in service on March 18. Assuming that B&P makes a Section 179 election, compute B&P's adjusted tax basis in the property at the end of 2017.

A) $99,900

B) $71,920

C) $79,920

D) $0

Correct Answer:

Verified

Q101: Terrance Inc., a calendar year taxpayer, purchased

Q103: NRW Company, a calendar year taxpayer, purchased

Q104: Which of the following statements about the

Q104: Creighton, a calendar year corporation, reported $5,571,000

Q105: Shelley purchased a residential apartment for $1,400,000

Q107: Driller Inc. has $498,200 of unrecovered capitalized

Q108: Follen Company is a calendar year taxpayer.

Q109: On November 7, a calendar year business

Q110: Which of the following intangible assets is

Q111: On May 1, Sessi Inc., a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents