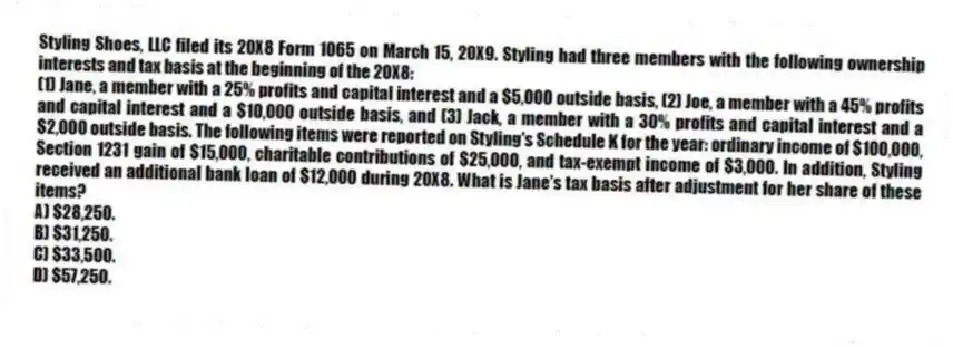

Styling Shoes, LLC filed its 20X8 Form 1065 on March 15, 20X9. Styling had three members with the following ownership interests and tax basis at the beginning of the 20X8:

(1) Jane, a member with a 25% profits and capital interest and a $5,000 outside basis, (2) Joe, a member with a 45% profits and capital interest and a $10,000 outside basis, and (3) Jack, a member with a 30% profits and capital interest and a $2,000 outside basis. The following items were reported on Styling's Schedule K for the year: ordinary income of $100,000, Section 1231 gain of $15,000, charitable contributions of $25,000, and tax-exempt income of $3,000. In addition, Styling received an additional bank loan of $12,000 during 20X8. What is Jane's tax basis after adjustment for her share of these items?

A) $28,250.

B) $31,250.

C) $33,500.

D) $57,250.

Correct Answer:

Verified

Q67: Which of the following items will affect

Q68: On January 1, X9, Gerald received his

Q69: Which of the following statements regarding the

Q70: Which person would generally be treated as

Q71: John, a limited partner of Candy Apple,

Q71: Does adjusting a partner's basis for tax-exempt

Q73: What is the difference between the aggregate

Q73: How does additional debt or relief of

Q75: If partnership debt is reduced and a

Q76: Which of the following statements regarding a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents