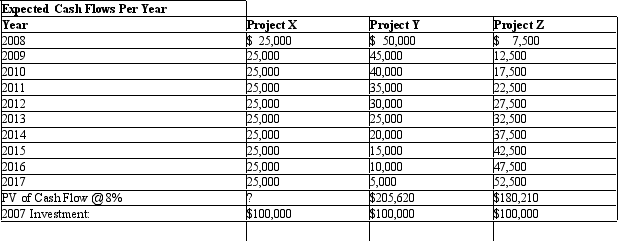

Certainty Equivalent Method. Saddie Hawkins, a management analyst with Mobile Telephone Services, Inc., has collected the following information about three investment projects undertaken by the firm during the past six month period. Hawkins wishes to use this information as a backdrop against which to evaluate the attractiveness of a recent investment proposal put forth by the quality control department. In that proposal, dubbed Project X, the quality control department proposes to spend $100,000 to modify transmission equipment at the Colorado Springs, Colorado facility. Annual expected cost savings of $25,000 per year over the 10-year 2005-2014 period have been projected, and verified as reasonable by Hawkins.

A. Calculate the present value of anticipated cost savings using an 8% discount rate as a reasonable estimate of the risk-free cost of capital.

A. Calculate the present value of anticipated cost savings using an 8% discount rate as a reasonable estimate of the risk-free cost of capital.

B. In light of the $100,000 investment required for each of these projects, and the discounted present value of future benefits, calculate the certainty equivalent adjustment factor a implicit in the decision to fund each of these investment projects.

C. Assume that the a's implicit in the decisions to fund projects Y and Z represent the upper limits for investment projects of this type. Would a decision to fund project X be consistent or inconsistent with the firm's decision to fund projects Y and Z?

Correct Answer:

Verified

Q25: Certainty Equivalents. Rajun Cajun's, Ltd., is a

Q26: Probability Analysis. WD-50, Inc. has just completed

Q27: Risk Attitudes. Identify each of the following

Q28: Expected Return Analysis. Barry Bonds offers free

Q29: A risk seeking decision maker displays:

A) increasing

Q31: Probability Analysis. Tex-Mex, Inc. is a rapidly

Q32: Certainty Equivalents. Rabbit Food, Inc., is a

Q33: Expected Return Analysis. Alex P. Keaton has

Q34: Probability Analysis. Ceramic Tile, Inc. wishes to

Q35: Probability Analysis. The Seattle HMO, Inc. is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents