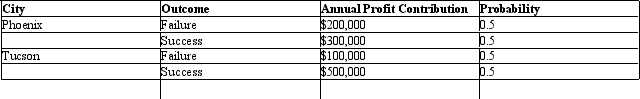

Probability Analysis. Tex-Mex, Inc. is a rapidly growing chain of Mexican-food restaurants. The company has a limited amount of capital for expansion, and must carefully weigh available alternatives. Currently, the company is considering opening restaurants in Phoenix and/or Tucson, Arizona. Projections for the two potential outlets are:

Each restaurant would involve a capital expenditure of $1.5 million, plus land acquisition costs of $500,000 for Phoenix and $1,050,000 for Tucson. The company uses the 10% yield on riskless U.S. Treasury bills to calculate the risk-free annual opportunity cost of investment capital.

Each restaurant would involve a capital expenditure of $1.5 million, plus land acquisition costs of $500,000 for Phoenix and $1,050,000 for Tucson. The company uses the 10% yield on riskless U.S. Treasury bills to calculate the risk-free annual opportunity cost of investment capital.

A. Calculate the expected value, standard deviation, and coefficient of variation for each outlet's profit contribution.

B. Calculate the minimum certainty equivalent adjustment factor for each restaurant's cash flows that would justify investment in each outlet.

C. Assuming the management of Tex-Mex is risk averse, and uses the certainty equivalent method in decision making, which is the more attractive outlet? Why?

Correct Answer:

Verified

Q26: Probability Analysis. WD-50, Inc. has just completed

Q27: Risk Attitudes. Identify each of the following

Q28: Expected Return Analysis. Barry Bonds offers free

Q29: A risk seeking decision maker displays:

A) increasing

Q30: Certainty Equivalent Method. Saddie Hawkins, a management

Q32: Certainty Equivalents. Rabbit Food, Inc., is a

Q33: Expected Return Analysis. Alex P. Keaton has

Q34: Probability Analysis. Ceramic Tile, Inc. wishes to

Q35: Probability Analysis. The Seattle HMO, Inc. is

Q36: Decision Trees. Atlanta Corporation has been supplying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents