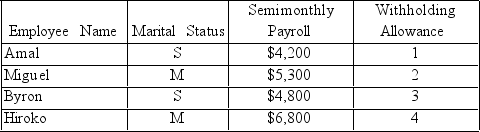

Maeda Company has the following employees on the payroll:

Using the information above,what are the annual amounts that would be used to complete a Form W-2 for Hiroko.

Using the information above,what are the annual amounts that would be used to complete a Form W-2 for Hiroko.

a.Gross Wages:

b.Federal Withholding:

c.Social Security Tax:

d.Medicare Tax:

Correct Answer:

Verified

Q111: A taxpayer had AGI of $300,000 in

Q112: Maeda Company has the following employees on

Q113: Maeda Company has the following employees on

Q114: K.Kruse Designs has the following employees:

Q115: Kim works part-time for Medical Assistants Inc.,and

Q116: Griffith & Associates is trying to determine

Q117: A taxpayer with an AGI of $300,000

Q118: Kathy received a commission of $12,000 from

Q119: Employers are required to deposit FUTA taxes

Q120: Failure to furnish a correct TIN to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents