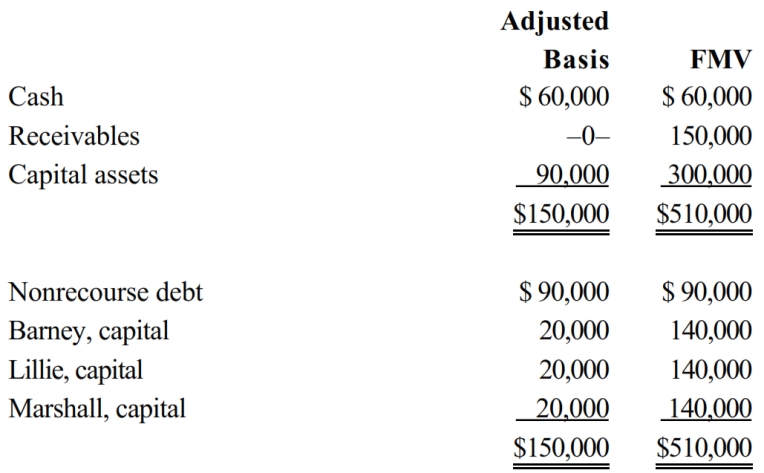

The BLM LLC's balance sheet on August 31 is as follows.

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

A) $100,000 capital gain? $50,000 ordinary income.

B) $120,000 capital gain? $0 ordinary income.

C) $150,000 capital gain? $0 ordinary income.

D) $150,000 capital gain? $50,000 ordinary income

E) $70,000 capital gain? $50,000 ordinary income.

Correct Answer:

Verified

Q142: Which of the following statements is true

Q220: In a proportionate liquidating distribution in which

Q221: Nicholas is a 25% owner in the

Q222: In a proportionate liquidating distribution, Sara receives

Q223: In a proportionate liquidating distribution of his

Q224: Susan is a one-fourth limited partner in

Q227: On June 30 of the current tax

Q228: Randy owns a one-fourth capital and profits

Q229: Connie owns a one-third capital and profits

Q230: Josh has a 25% capital and profits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents