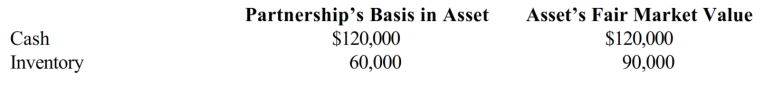

Randy owns a one-fourth capital and profits interest in the calendar-year RUSR Partnership. His adjusted basis for his partnership interest was $200,000 when he received a proportionate nonliquidating distribution of the following assets.

a. Calculate Randy's recognized gain or loss on the distribution, if any. Explain.

b. Calculate Randy's basis in the inventory received.

c. Calculate Randy's basis for his partnership interest after the distribution.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Which of the following statements is true

Q223: In a proportionate liquidating distribution of his

Q224: Susan is a one-fourth limited partner in

Q225: The BLM LLC's balance sheet on August

Q227: On June 30 of the current tax

Q229: Connie owns a one-third capital and profits

Q230: Josh has a 25% capital and profits

Q231: The December 31 balance sheet of the

Q232: In a proportionate liquidating distribution in which

Q233: Michelle receives a proportionate liquidating distribution when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents