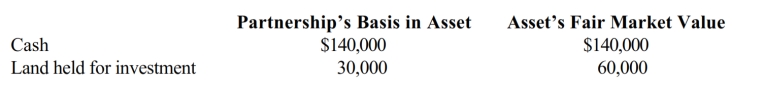

Connie owns a one-third capital and profits interest in the calendar-year CDB Partnership. Her adjusted basis for her partnership interest was $120,000 when she received a proportionate current (nonliquidating) distribution of the following assets.

a. Calculate Connie's recognized gain or loss on the distribution, if any.

b. Calculate Connie's basis in the land received.

c. Calculate Connie's basis for her partnership interest after the distribution.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Which of the following statements is true

Q158: In a proportionate liquidating distribution, Ashleigh receives

Q224: Susan is a one-fourth limited partner in

Q225: The BLM LLC's balance sheet on August

Q227: On June 30 of the current tax

Q228: Randy owns a one-fourth capital and profits

Q230: Josh has a 25% capital and profits

Q231: The December 31 balance sheet of the

Q232: In a proportionate liquidating distribution in which

Q233: Michelle receives a proportionate liquidating distribution when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents