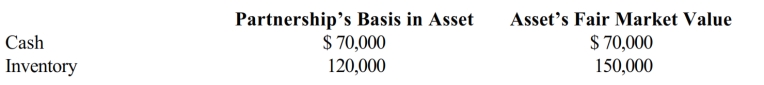

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership. His adjusted basis for his partnership interest on October 15 of the current year is $300,000. On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

a. Calculate Josh's recognized gain or loss on the liquidating distribution, if any, and his basis in the distributed inventory.

How would your answer to

a. change if the partnership also distributed a small parcel of land it

b. had held for investment to Josh? Assume the land has a $5,000 adjusted basis (FMV is $8,000) to the partnership.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Which of the following statements is true

Q158: In a proportionate liquidating distribution, Ashleigh receives

Q220: Melissa is a partner in a continuing

Q225: The BLM LLC's balance sheet on August

Q227: On June 30 of the current tax

Q228: Randy owns a one-fourth capital and profits

Q229: Connie owns a one-third capital and profits

Q231: The December 31 balance sheet of the

Q232: In a proportionate liquidating distribution in which

Q233: Michelle receives a proportionate liquidating distribution when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents