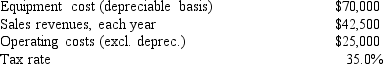

Whitestone Products is considering a new project whose data are shown below.The required equipment has a 3-year tax life, and the accelerated rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

A) $11, 904

B) $12, 531

C) $13, 190

D) $13, 850

E) $14, 542

Correct Answer:

Verified

Q56: Which of the following statements is CORRECT?

A)

Q57: Tallant Technologies is considering two potential projects,

Q58: In your first job with TBL Inc.your

Q59: When evaluating a new project, firms should

Q60: Which of the following should be considered

Q62: Sylvester Media is analyzing an average-risk project,

Q63: Spot-Free Car Wash is considering a new

Q64: Weston Clothing Company is considering manufacturing a

Q65: McPherson Company must purchase a new milling

Q66: Your new employer, Freeman Software, is considering

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents