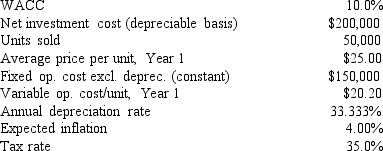

Sylvester Media is analyzing an average-risk project, and the following data have been developed.Unit sales will be constant, but the sales price should increase with inflation.Fixed costs will also be constant, but variable costs should rise with inflation.The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value.This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made vs.if it is not made?

A) $13, 286

B) $13, 985

C) $14, 721

D) $15, 457

E) $16, 230

Correct Answer:

Verified

Q57: Tallant Technologies is considering two potential projects,

Q58: In your first job with TBL Inc.your

Q59: When evaluating a new project, firms should

Q60: Which of the following should be considered

Q61: Whitestone Products is considering a new project

Q63: Spot-Free Car Wash is considering a new

Q64: Weston Clothing Company is considering manufacturing a

Q65: McPherson Company must purchase a new milling

Q66: Your new employer, Freeman Software, is considering

Q67: Garden-Grow Products is considering a new investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents