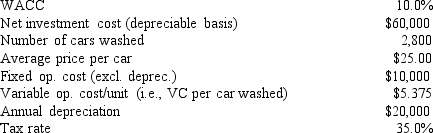

Spot-Free Car Wash is considering a new project whose data are shown below.The equipment to be used has a 3-year tax life, would be depreciated on a straight-line basis over the project's 3-year life, and would have a zero salvage value after Year 3.No new working capital would be required.Revenues and other operating costs will be constant over the project's life, and this is just one of the firm's many projects, so any losses on it can be used to offset profits in other units.If the number of cars washed declined by 40% from the expected level, by how much would the project's NPV decline? (Hint: Note that cash flows are constant at the Year 1 level, whatever that level is.)

A) $28, 939

B) $30, 462

C) $32, 066

D) $33, 753

E) $35, 530

Correct Answer:

Verified

Q58: In your first job with TBL Inc.your

Q59: When evaluating a new project, firms should

Q60: Which of the following should be considered

Q61: Whitestone Products is considering a new project

Q62: Sylvester Media is analyzing an average-risk project,

Q64: Weston Clothing Company is considering manufacturing a

Q65: McPherson Company must purchase a new milling

Q66: Your new employer, Freeman Software, is considering

Q67: Garden-Grow Products is considering a new investment

Q68: Taylor Inc., the company you work for,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents