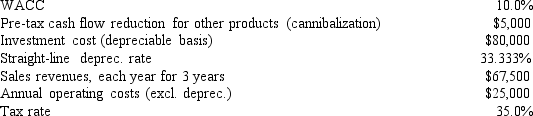

Weston Clothing Company is considering manufacturing a new style of shirt, whose data are shown below.The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.However, this project would compete with other Weston's products and would reduce their pre-tax annual cash flows.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $3, 636

B) $3, 828

C) $4, 019

D) $4, 220

E) $4, 431

Correct Answer:

Verified

Q59: When evaluating a new project, firms should

Q60: Which of the following should be considered

Q61: Whitestone Products is considering a new project

Q62: Sylvester Media is analyzing an average-risk project,

Q63: Spot-Free Car Wash is considering a new

Q65: McPherson Company must purchase a new milling

Q66: Your new employer, Freeman Software, is considering

Q67: Garden-Grow Products is considering a new investment

Q68: Taylor Inc., the company you work for,

Q69: DeVault Services recently hired you as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents