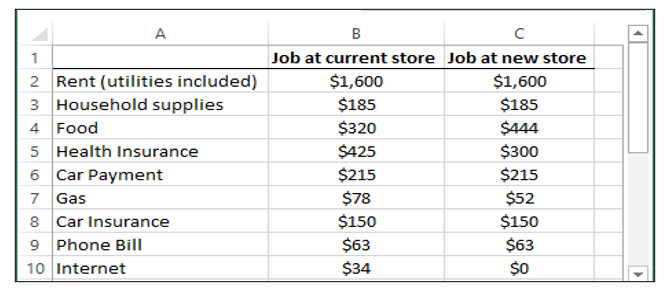

Archer is a sales associate at a music equipment store. He worked for this store for while finishing a degree at a local university. Archer is debating whether he should stay and accept a promoted role of manager in his current music store or accept a management position at a different store once he finishes his schooling. He determined that as a manager, his take home pay for both jobs will be $4,000 per month, and he constructed a following budget for each scenario:  Each job has different benefits. The new job pays for a larger portion of health insurance premiums, provides company-paid internet, and is closer to Archer's house, while the current job provides onsite lunches frequently resulting in a lower overall food budget. These different benefits result in differing amounts in the budget. Archer decided that any unspent funds will go to a savings account. With this information in mind, please answer the following questions. Use Excel or a similar spreadsheet where appropriate.

Each job has different benefits. The new job pays for a larger portion of health insurance premiums, provides company-paid internet, and is closer to Archer's house, while the current job provides onsite lunches frequently resulting in a lower overall food budget. These different benefits result in differing amounts in the budget. Archer decided that any unspent funds will go to a savings account. With this information in mind, please answer the following questions. Use Excel or a similar spreadsheet where appropriate.

a. Under each budget, how much will Archer be able to put in his savings account? What is the percent difference in savings that Archer can amass per month? How many months would it take in each scenario to save enough money to afford a down payment of $22,500 towards a new house?

b. Create a chart for each job's budget to visualize the proportion of Archer's budget needed for each category in each scenario. What chart is appropriate for this, and why is it the best option? What type of data analytics is this an example of?

c. Assume Archer decides to stay at his current job and accept the management role. He did a good job in his first month of the new role but he did go over budget in a few areas. His actual spending was $340 on food, $71 on phone, and $191 on household supplies. Create a chart to show the budgeted and actual amounts for each category. To add some diagnostic analysis, provide at least three plausible explanations for the overages.

d. Now, assume Archer decides to accept the management position in a different store, and his actual spending was $502 on food, $89 on gas, $71 on phone, and $199 on household supplies. Create a chart to show the budgeted and actual amounts for each category. To add some diagnostic analysis, provide at least three plausible explanations for the overages.

e. Archer has come to you for guidance and help deciding what job to take based on the available information gathered in parts a-d. Which job would you advise him take, and why? How could Archer use what-if analysis, a form of prescriptive analytics, to help with this decision? What is a potential scenario that Archer should investigate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Samantha is a Human Resource Associate for

Q132: Phoebe started her first job out of

Q133: Larry is the owner and operator of

Q134: Jeweltopia is a trendy online jewelry boutique

Q135: Wally's Window Emporium is a leading producer

Q136: Wally's Window Emporium is a leading producer

Q137: Chocolate Delights Company manufactures gourmet chocolate candy

Q138: Chocolate Delights Company manufactures gourmet chocolate candy

Q139: Starling Corporation completed their fifth year of

Q140: Simon recently completed the third year of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents